YOU DESERVE A GREAT RETIREMENT

Transitioning into retirement doesn’t have to be overwhelming. Launch Your Retirement offers simple, step-by-step guidance on the five key areas of planning: income, investments, taxes, healthcare, and legacy.

Create a personalized retirement plan that suits your needs, so you can focus on enjoying the years ahead. Start building the secure future you deserve today!

“Retirement isn’t about reaching the finish line, it’s about what happens after you cross it”

FREE EBOOK

Get your free ebook today and learn how you can change your retirement.

ABOUT THE BOOK

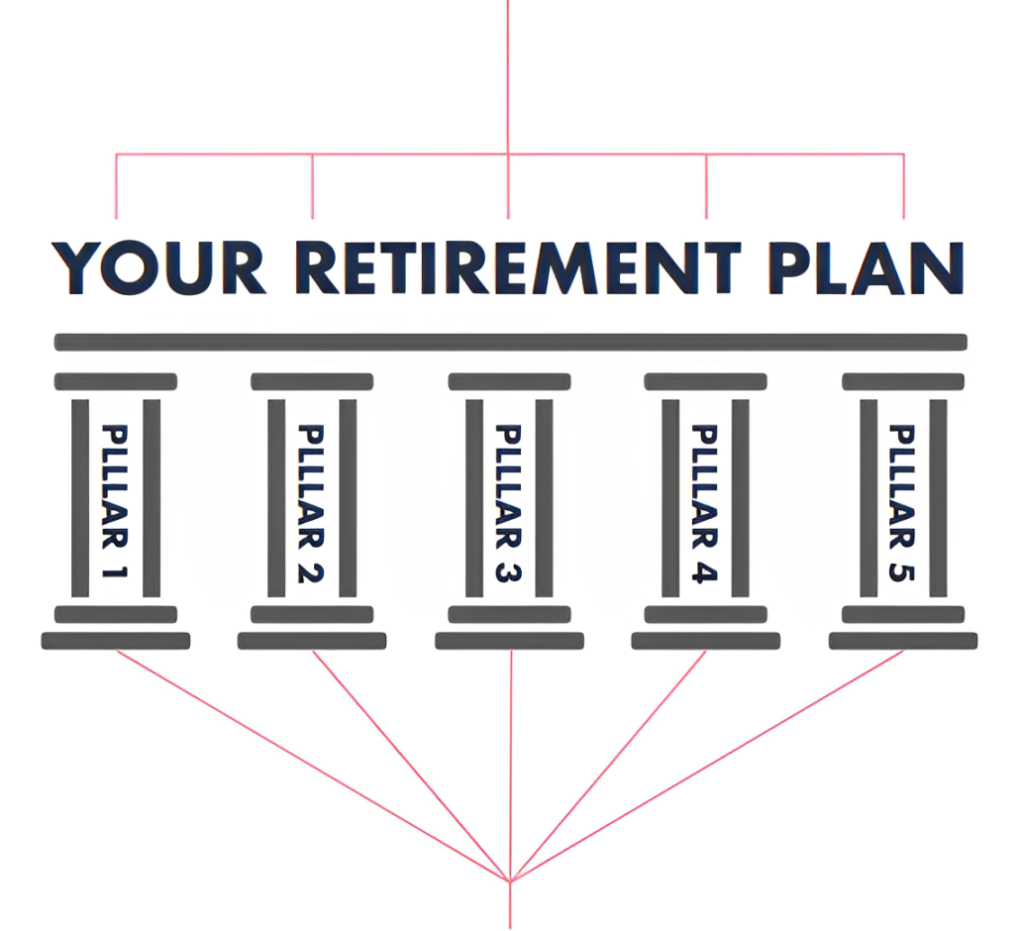

Why the 5 Pillars System?

Transitioning into your retirement years can be overwhelming, but understanding the roads to a wholistic retirement plan doesn’t have to be. Launch Your Retirement is a step-by-step guide that walks you through the 5 essential areas of retirement planning: income, investments, taxes, healthcare and legacy planning aimed at building a strong financial foundation for your retirement.

With a personalized and strategic approach to your retirement, you will be able to craft your own retirement blueprint and learn the tools you need to design the retirement you deserve.

HOW DOES IT WORK?

The 5 Pillars and how they work together to build you a strong financial house

PILLAR 1: Income Planning

PILLAR 2: Investment Planning

PILLAR 3: Tax Planning

PILLAR 4: Healthcare Planning

PILLAR 5: Legacy Planning

The Retirement you have been Dreaming of

”When you have a holistic plan that covers all 5 pillars, the value [you have] compounds”

ABOUT THE AUTHOR

TED THATCHER

President Bright Lake Wealth

Ted Thatcher is the president of Bright Lake Wealth Management. As a financial advisor, he also serves as the president of the American Financial Education Alliance [AFEA – 501(c)(3)] Medford, Oregon, and Redding, California, chapters. The passion he has for his field was born from the love of his family and preparing for their future, which overflows to his offices.He prides himself on creating an education-focused environment where he focuses on you and your future goals. As a financial advisor, it is Ted’s goal that each person he meets has a written plan to help protect his or her retirement so that everyone possesses the confidence so many people only hope to have in their retirement. He believes this confidence is achieved by executing a written plan he calls the Bright Lake Wealth Blueprint. It is with tools like this that Ted has helped people grow and preserve their retirement assets.