Ted Thatcher is the president of Bright Lake Wealth Management. As a financialadvisor, he also serves as the president of the American Financial EducationAlliance [AFEA – 501(c)(3)] Medford, Oregon, and Redding, California, chapters. The passion he has for his field was born from the love of his family and preparing for their future, which overflows to his offices. He prides himself on creating an education-focused environment where he focuses on you and your future goals.

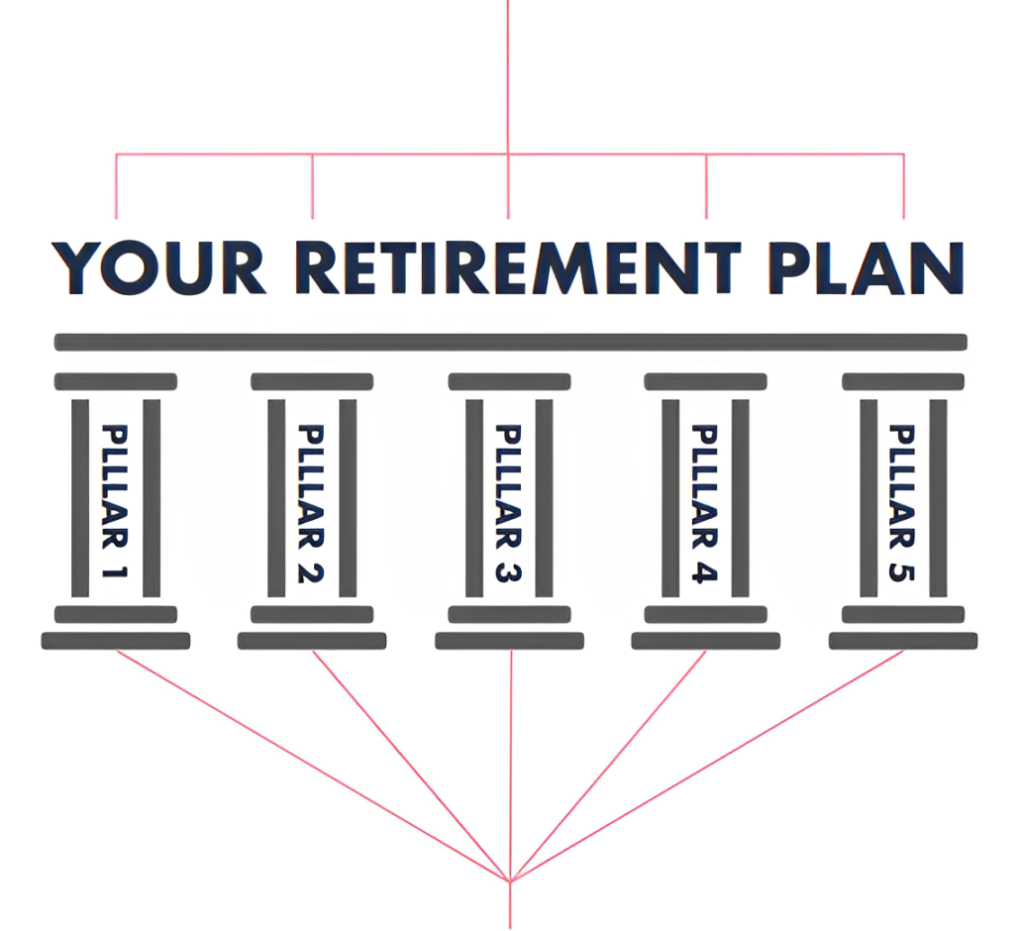

As a financial advisor, it is Ted’s goal that each person he meets has a written plan to help protect his or her retirement so that everyone possesses the confidence so many people only hope to have in their retirement. He believes this confidence is achieved by executing a written plan he calls the Bright Lake Wealth Blueprint. It is with tools like this that Ted has helped people grow and preserve their retirement assets.